El Pantano Project

The El Pantano Project is an early-stage gold and silver exploration project in the Deseado Massif region of Santa Cruz state in southern Argentina.

The Deseado Massif is a large area (>60,000km2) of mid to late Jurassic volcanic rocks in southern Argentina. The region has in recent decades been shown to host numerous high-grade tier-1 gold and silver deposits, the two largest being Anglo Gold’s Cerro Vanguardia mine and Newmont Mining’s Cerro Negro deposit. Other substantial projects include Yamana Gold’s Cerro Moro and Pan American Silver’s Manantial Espejo silver deposit.

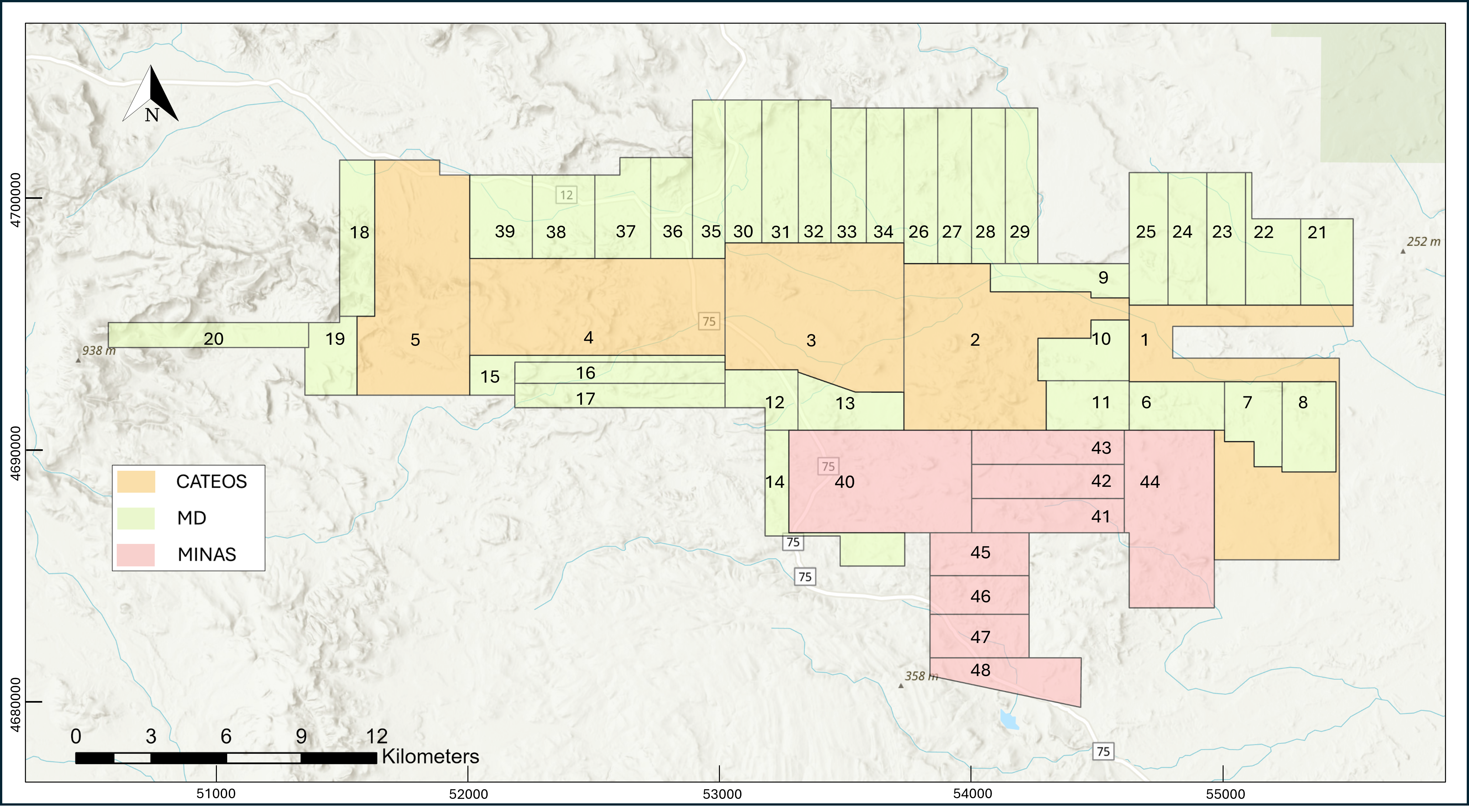

Tenure

The El Pantano Project comprises a number of contiguous exploration licences, now totalling some 550km2 in area.

Access to the Project is by good, paved road several hours drive south from the regional city of Comodoro Rivadavia, and then roughly 50km travel on good quality dirt roads west from the Tres Cerros Roadhouse.

The region is barren and sparsely populated, largely as a result of the near complete devastation of the region’s agricultural industry by ashfall from the 1991 eruption of Mt Hudson.

JV Details

The general terms of the Agreement allow for the Company to earn 100% equity in the Project by investing US$3m over five years in two phases:

- Phase 1, earn 51% by investing US$1m over an initial 3-year period.

- Phase 2, move to 100% ownership by investing an additional US$2m over a subsequent 2-year period and granting Deseado a residual 2% net smelter return royalty on the Project.

Geology

The Project is almost completely dominated by Jurassic volcanic rocks that are known to be the primary host of gold and silver mineralisation across the Massif. Much of the area, however, is covered by late basalts, which when coupled with the Project’s remote location has possibly contributed to a lower level of historical exploration that might otherwise have been expected given its attractive geology.

Preliminary field inspections undertaken by the Company’s geological team have noted large erosional windows within the basalt cover that have exposed extensive areas of prospective volcanics, swarms of gold bearing quartz veins and areas of pervasive silicification all within a major SE-NW regional structure that is clearly evident on regional government airborne magnetic data.

Previous soil and rock sampling programs have identified areas of gold anomalism, and the flat and easily traversed terrain and nature of soil development suggest the area to be amenable to very cost-effective exploration techniques.

Exploration History

The El Pantano Project has seen very little modern exploration, despite its attractive geology. This is probably in part due to the relative isolation and the fact that this is the first time the entire region has been amalgamated into a single contiguous licence package.

The eastern section of the project area was explored in a cursory fashion by TSX.V listed Minsud Resources from 2011 through to 2016, however this work was largely limited to cursory mapping and sampling and some ground geophysical surveys.

Several advanced projects and resources exist immediately to the south of the project defined by other companies.

In the three years from commencement of the JV in February, 2022, the company has carried out extensive reconnaissance exploration programs across the project, including geological mapping, geochemical sampling, ground magnetic surveys and induced polarisation (IP) surveys.

These work programs, albeit regional and surficial in nature, confirmed the Company’s contention that the area hosts a major epithermal system. These programs were also sufficient to meet Phase 1 JV obligations, taking the Company to 51% ownership in February 2025.

In November 2025, the Company commenced the first drill program ever undertaken in the Project area. A 3000m diamond drill program was designed as the first phase to test geological concepts and provide guidance for further work. This program, once completed should also come close to meeting Phase 2 obligations of the JV, thus taking the Company to 100% ownership.