Anzá is Orosur’s flagship project.

After being acquired by Orosur in 2014, the project saw little work as the Company focussed on its Uruguay operations, but since late 2020, Anzá was transformed into our main asset and one of the more exciting gold projects in the region.

From September 2018, the Anzá project was a JV between Orosur, and Colombian company Minera Monte Aguila (MMA), owned 50/50 by Newmont Corporation and Agnico Eagle Mines. MMA managed and funded exploration programs across the licence package.

In November 2024, Orosur completed a transaction whereby it purchased for delayed consideration, all the shares of MMA, thereby returning to 100% ownership of the Anzá Project.

In addition to returning to 100% ownership of the original licences and applications, this acquisition also resulted in Orosur acquiring numerous applications owned by MMA, thus more than doubling its total landholding, making it one of the dominant holders in Colombia’s major belt.

Tenure

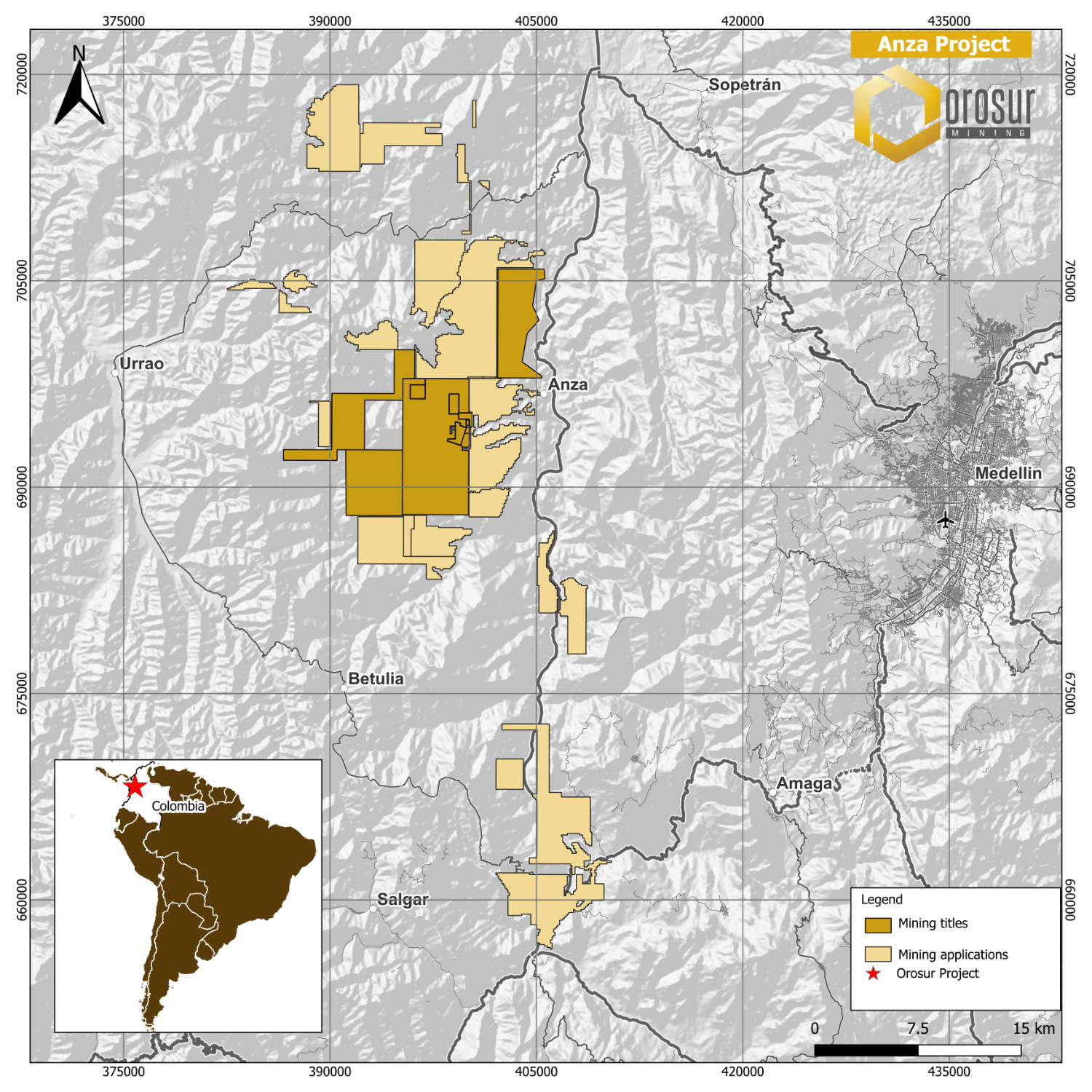

From November 2024, the Anzá Project has increased in area as a result of reductions in several previous applications and by the addition of applications made by Orosur and applications owned by MMA that were acquired as part of the JV transaction.

The Anzá project now consists of three granted exploration licences and a number of applications, totalling roughly 330km2 in area.

The Company is constantly assessing its land package and is actively working to move several key applications to granted status

MMA Acquisition Terms

Following OMI’s acquisition of MMA in November 2024, the former JV lapses and is no longer in effect.

The agreed consideration for the transaction is an NSR of 1.5% on all future mineral production, plus an additional fixed royalty of US$75 per ounce of gold or gold equivalent ounce for the first 200,000 gold equivalent ounces of mineral production.

Geology

The Anzá project is located in the Western Cordilleran region of Colombia, 50 km west of Medellin (107 km by road) and a few km west of the River Cauca.

The project lies withing the N-S trending Mid-Cauca belt.

The Mid-Cauca Belt is defined as a belt of late Miocene porphyry and related deposits hosted in the Romeral melange northwest Colombia (Figure. 1).

The primary large-scale driving force for mineralization in this region is the gradual subduction of the Nazca oceanic crust under the continental South American plate at roughly 15cm per year (Figure 2)

As this oceanic crust and its sediment load is subducted, it is remelted, which in turns creates upwellings of volatile magma that has led to the volcanic arc that is the Andes mountain range. This active volcanism is the source of both the metals and the heat to drive the geological processes that ultimately lead to a range of mineral deposits, along, and on either side of the Andes Arc.

The mid-Cauca belt lies to the east of the Andes in a geological setting referred to as a “back-arc” basin and shows a variety of mineralisation styles such as porphyry Cu/Au, epithermal gold and VMS deposits (Figure 3). While distinctly different in size, grade and chemistry, all of these types of mineralisation share a common origin of a deep-seated intrusion as the source of metals and heat.

Exploration History

The Anzá Project came under Orosur’s control in June 2014 upon the completion of a Plan of Arrangement between Orosur Mining and TSX listed Waymar Resources, that in effect merged the two companies.

Waymar had acquired the project some years before after being spun out from Continental Gold upon its decision to concentrate on the Buritica deposit in Colombia.

Waymar had carried out some significant exploration programs, at Anzá, including some 18,000m of drilling, concentrated on the central APTA deposit, as well as some regional sampling carried out in cooperation with Anglo Gold.

Post-merger, Orosur then completed several smaller exploration and drilling phases at APTA and Charrascala, for some 6,000m. However, from 2018, exploration work was wound back as the company focussed on the wind up of its San Gregorio operations in Uruguay.

The now defunct Joint Venture with Newmont Mining Corporation was signed in September 2018, allowing it a three phased earn-in of up to 75% in Anzá by spending a minimum US$30.0mm over 12 years, completing an NI 43-101 feasibility study & making cash payments to Orosur equalling US$4.0mm, and by taking a US$2mm equity placement in the company, acquiring 29,213,186 shares.

In October 2020, it was announced that Agnico Eagle Mines Ltd, would join Newmont on a 50:50 basis to share its rights and responsibilities with regard to the Anzá joint venture.

Drilling recommenced on the project in November 2020, after a hiatus of several years.

Newmont then made the corporate decision to exit Colombia in late 2023. Thence followed a lengthy period of negotiation, leading to Orosur’s purchase of Newmont and Agnico’s Colombian Joint Venture company at the end of November 2024, taking Orosur back to 100% ownership of the Project.

Following the completion of Orosur’s purchase of MMA, the Company began its own exploration programs in mid-November 2024

Technical Reports

| Date | File Name | Download |

|---|---|---|

| January 2019 | January 2019 – Anzá Technical Report | |

| May 2010 | May 2010 – Anzá Technical Report |